Way back at the Office 2.0 conference FreshBooks CEO Mike McDerment dropped a bomb in the last 20 seconds in his presentation: being software as as service, they can aggregate customers’ data, categorize it by industry, size ..etc, and once they do that, why not turn it into a service, providing customers with their own performance metrics as well as benchmarking them against their peers.

Way back at the Office 2.0 conference FreshBooks CEO Mike McDerment dropped a bomb in the last 20 seconds in his presentation: being software as as service, they can aggregate customers’ data, categorize it by industry, size ..etc, and once they do that, why not turn it into a service, providing customers with their own performance metrics as well as benchmarking them against their peers.

A few months later, the Small Business Report Card service will launch tomorrow at the Web 2.0 Expo as well as online. The service will be free to all Freshbooks customers, who will:

- all receive their own performance metrics, and

- if they select their peer group based on (currently) 80 types of business / professions, geography and several other business criteria, they will also receive their relative position, “score-card” within that group.

The sample below is a mock-up of the actual Report Card, but is shows the initial metrics reported. Clearly, as they further enhance the program, there will be more and more criteria, and FreshBooks customers will have a say in what performance metrics they find valuable.

Remember, FreshBooks’ customers are mostly small businesses who don’t have an army of MBA-types crunch the numbers and look for business (in)efficiencies. In fact it’s probably fair to say some would not even know how to interpret the numbers, until they are put in prospective – hence the value of relative benchmarking.

But why will SaaS never be the same? This isn’t just about FreshBooks and its customers.

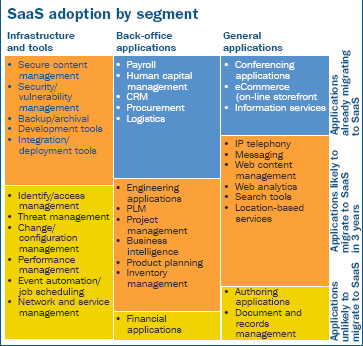

It’s *the* hidden business model enabled by SaaS. An opportunity not talked about, but so obvious it has to be on the back of all SaaS CEO’s mind. Benchmarking is a huge business, practiced by research firms like Forrester, Hoovers, Dunn and Bradstreet, as well as by specialized shops like the Hackett group – none of which are affordable to small businesses. More importantly, all previous benchmarking efforts were hampered by the quality of source data, which, with systems behind firewalls was at least questionable. SaaS providers will have access to the most authentic data ever, aggregation if which leads to the most reliable industry metrics and benchmarking.

Being pioneers always carries a risk, and clearly, Freshbooks will have to keep an eye on their customers feedback. There may be a backlash due to data privacy/ownership concerns; some customers will not opt in, they may even lose some customers entirely. But I believe the majority will see the light and benefit from the service. If Mike’s blog post on the subject is any indication, the feedback there was overwhelmingly positive, with 13 comments for, 3 against.

I suspect a year or two from now benchmarking based on aggregate customer data will be standard industry practice, and little (?) FreshBooks will be looked upon as the pioneers who opened up the floodgate of opportunities.

Last, but not least a word on the creative launch – or a lesson on how to launch from a conference you don’t officially participate at :

:

Yugma is a web-conferencing company and an exhibitor at Web 2.0 Expo. What better way to demo a web-conferencing product than by showing real-live use… without Yugma having to move a finger to create content. They created Stage 2, a platform for companies to showcase their products remotely at the Yugma booth and simultaneously to the World through a Net broadcast. Both the presenters and Yugma win – congrat’s, and my personal Creativity Award to Yugma

Yugma is a web-conferencing company and an exhibitor at Web 2.0 Expo. What better way to demo a web-conferencing product than by showing real-live use… without Yugma having to move a finger to create content. They created Stage 2, a platform for companies to showcase their products remotely at the Yugma booth and simultaneously to the World through a Net broadcast. Both the presenters and Yugma win – congrat’s, and my personal Creativity Award to Yugma

Update (4/19): read Jeff Nolan’s comments.

Update (10/8/2008): Congrat’s to Freshbooks for getting on Fox Business.

SAP held major internal announcements and demos of its

SAP held major internal announcements and demos of its

24SevenOffice

24SevenOffice

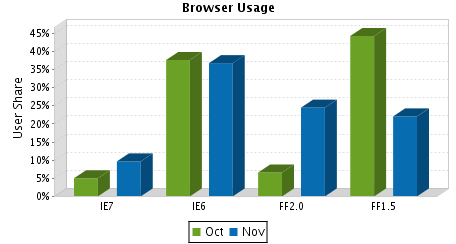

). Clearly, the majority of new IE7 users are not IE6 upgraders, they came from the Firefox camp.

). Clearly, the majority of new IE7 users are not IE6 upgraders, they came from the Firefox camp.

Recent Comments