A few years ago this would have been a crazy question. A bookstore against a search engine? Apples and oranges… not anymore. Still, we’re more used to pitting Google against Yahoo, Amazon against eBay. But think about it:

Adoption of Amazon Elastic Compute Cloud (EC2) and Amazon Simple Storage Service (S3) continues to grow. As an indicator of adoption, bandwidth utilized by these services in fourth quarter 2007 was even greater than bandwidth utilized in the same period by all of Amazon.com’s global websites combined.

The above quote is from Amazon’s earnings release. There are more then 330,000 developers registered to use Amazon Web Services. Some of these new Web 2.0 offerings will actually take off, in fact some will get mass adoption. That translates to tens of millions of users whose online activity flows through Amazon, and this is where Google comes in the picture.

Forget Search, Google is the world’s primary Advertising engine. They need to have (I did not say own!) all our data. Nick Carr is right:

For Google, literally everything that happens on the Internet is a complement to its main business. The more things that people and companies do online, the more ads they see and the more money Google makes. In addition, as Internet activity increases, Google collects more data on consumers’ needs and behavior and can tailor its ads more precisely, strengthening its competitive advantage and further increasing its income.

The business models are different: for Google everything you do is secondary (and largely free to you), since they make their money on the ads, while Amazon directly charges for their individual services (albeit not much). Amazon will have tens of  millions of users, and Google wants them, too.

millions of users, and Google wants them, too.

If we buy into Nick Carr’s “Big Switch” vision of utility computing (and I do), are these two giants competing to become “The Cloud computer”? Or perhaps one of the 5?

Related posts: ReadWriteWeb, TechCrunch, Between the Lines, Data Center Knowledge, ProgrammableWeb.

I had mixed thoughts at first reading: Obviously environmental consciousness is becoming fashionable. Companies rush to launch their green initiatives in order to look “responsible corporate citizens”. OK, that’s the cynical view, but after all, these are often useful initiatives, and I’ve already said you

I had mixed thoughts at first reading: Obviously environmental consciousness is becoming fashionable. Companies rush to launch their green initiatives in order to look “responsible corporate citizens”. OK, that’s the cynical view, but after all, these are often useful initiatives, and I’ve already said you

Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

I am an advisor to Zoho. Don’t just take my word – go and

I am an advisor to Zoho. Don’t just take my word – go and

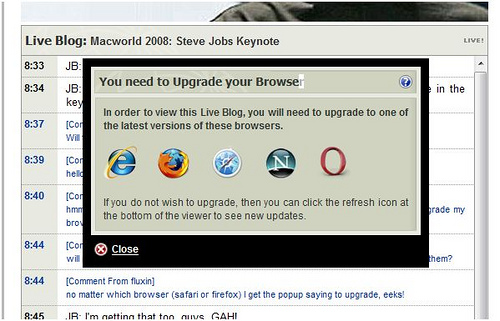

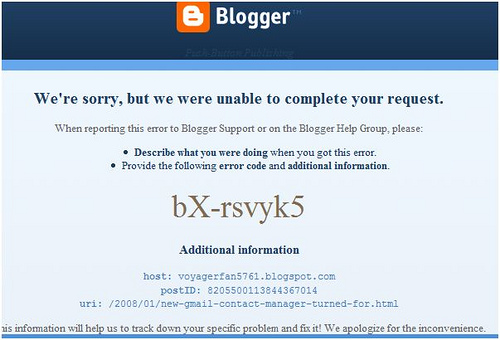

In a funny (scary?) case of coincidence, the

In a funny (scary?) case of coincidence, the

Recent Comments