(Updated – see podcast links at the bottom)

(Updated – see podcast links at the bottom)

I’ll be moderating another SVASE VC Breakfast Club meeting on Thursday, Aug 10th in San Francisco, at the Embarcadero Center. As usual, it’s an informal round-table where up to 10 entrepreneurs get to deliver a pitch, then answer questions and get critiqued by a VC Partner. We’ve had VC’s from Draper Fisher, Hummer Winblad, Kleiner Perkins, Mayfield, Mohr Davidow, Emergence Capital …etc.

Thursday’s featured VC is Chris Hollenbeck, Managing Director, Granite Ventures. The Zvents post has all the info and a map, and if you plan to attend, please register here.

These sessions are a valuable opportunity for Entrepreneurs, most of whom would probably have a hard time getting through the door to VC Partners. Since I’ve been through quite a few of these sessions, both as Entrepreneur and Moderator, let me share a few thoughts:

- It’s a pressure-free environment, with no Powerpoint presentations, Business Plans…etc, just casual conversation, but it does not mean you should come unprepared!

- Bring an Executive Summary, some VC’s like it, others don’t.

- Follow a structure, don’t just talk freely about what you would like to do, or even worse, spend all your time describing the problem, without addressing what your solution is.

- Don’t forget “small things” like the Team, Product, Market..etc.

- It would not hurt to mention how much you are looking for, and how you would use the funds…

- Write down and practice your pitch, and prepare to deliver a compelling story in 3 minutes. You will have about 5, but believe me, whatever your practice time was, when you are on the spot, you will likely take twice as long to deliver your story. The second half of your time-slot is Q&A with the VC.

- Last, but not least, please be on time! I am not kidding… some of you know why I even have to bring this up.

Here’s a participating Entrepreneur’s feedback about a previous event.

Update (8/13): Listen to these podcasts recorded at the VC Breakfast by Vic at HotfromSiliconValley:

Click here to listen to the conversation with Chris Hollenbeck

Tags: Venture Capital, VC Breakfast, Funding, VC Funding, Startups, Entrepreneurship, SVASE

I generally like

I generally like

as the Palo Alto Farmer market.

as the Palo Alto Farmer market.

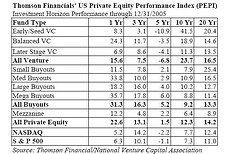

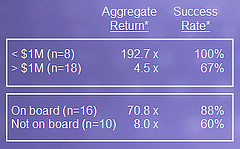

Talk about investment performance and Board participation, this chart by

Talk about investment performance and Board participation, this chart by

Recent Comments