(Updated)

I’m at TieCon 2006 at the Santa Clara Convention Center. Trying to park was a nightmare: 15 minutes circling in the parking structure. Last time I was here for Software 2006, I parked right next to the stairs. Finally got in, sitting in the back of the conference room (power source!), flip my laptop on, and Voila! – free wi-fi available… as it should be (at Software 2006 it cost $26/day)

Michael Malone, introducing John Doerr just made the same comment – he parked in Great America’s overflow parking …. 3,000+ participants. Entrepreneurial spirit is definitely back.

Raw notes from the discussion with John Doerr of Kleiner Perkins Caufield and Byers, a Silicon Valley VC Legend:

Raw notes from the discussion with John Doerr of Kleiner Perkins Caufield and Byers, a Silicon Valley VC Legend:

If you’re thinking of coming to KP just for money, it’s expensive: don’t come. Come for the networking resources, experience.

This being TiE, a few India-pecific questions. Response: Kleiner backed 100 companies over the past 4 years and half of those have Indian leadership. They are passionate, have a sense of wanting to give back to India and the world. KP is also active in in India, which happens to produce the largest pool of engineering pool in he world, English is spoken and it’s a democracy. KP made two recent investments in India.

New subject: Technology – what’s coming next? John Doerr: Biology. This is what he really wants to talk about, now he gets passionate. He talks about soon-to-debut “Inconvenient Truth” and shows a few powerful slides about Greenland shrinking, due to ice melt. If Greenland melted all, the oceans would rise by 20 feet. Just how much is that? – we get a feel when he shows a few slides of the Bay Area – oops, there goes the convention center we’re in…

New subject: Technology – what’s coming next? John Doerr: Biology. This is what he really wants to talk about, now he gets passionate. He talks about soon-to-debut “Inconvenient Truth” and shows a few powerful slides about Greenland shrinking, due to ice melt. If Greenland melted all, the oceans would rise by 20 feet. Just how much is that? – we get a feel when he shows a few slides of the Bay Area – oops, there goes the convention center we’re in…

So what can we do about it: need to reduce carbon emission. Opportunity for engineers, innovators, politicians: get efficient, produce growth requiring less energy, less pollution.

Kleiner Perkins has invested in 7 stealth GreenTech companies in the past 5 years. – $57M total invested in those. Huge potential business, ROI eventually may be bigger than “traditional” tech. areas, but wait for payback longer.

Tom “World is Flat” Friedman’s next book, Green is the New Red-White-blue: the current biggest enemy facing this country is not Islamism, Communism, or other such ideologies, but Petrolism. We need petrol tax to encourage getting energy efficient. It takes guts, not for the “girlie man”. (Timely quote from the Gubernator due to appear on a panel this afternoon.)

We’ve had no major innovation in energy for the past 30 years. China has higher automotive emission standards than the USA. If India and China develops the way the US has, we’re choking the world. We need to innovate.

Michael Malone: “you’re working with your heart, not your mind”. John Doerr: no, this will be the largest economic opportunity in the world.

On to the issue of the Pandemic Fly: Something of this magnitude happens 2-3 times in a century. Shows some slides of the devastation of the Spanish Flu. What can entrepreneurs do? Improve surveillance and diagnostics. KP backed startups working on inexpensive diagnostic devices, and vaccine expected to be 10 times more effective than Tamiflu. He is calling for backing entrepreneurs in this area. Distribution, pricing: give it away free or cheap in the developing world, sell it in the developed world..

On Social Entrereneurship: double bottom line. Build a sustainable operation and eliminate poverty. John Doerr has some more personal involvement in this area, not through Kleiner.

Politics: Silicon Valley traditionally was doing best by staying out of politics. John sees politics playing a bigger role. Advocate for policies that reduce the climate crisis and increase energy innovation.” Let’s have a President who will make “green ” a priority.

Social Entrepreneurs build should build scalable and sustainable businesses, but they don’t have to be profitable, just self-sustaining. Do you want to built an inconsequential Enterprise Software company or do something big? (This reminds me of Steve Jobs famous challenge to John Sculley: “Do you want to spend the rest of your life selling sugared water, or do you want to change the world?”)

In conclusion, John Doerr sums up what he is passionate about: “I want to revolutionize the energy industry, make investments in : fuel cell, solar, bio-fuels.

John’s call for action to the audience: If you’d like a copy of these slides, email me the titles of your three favorite books.

References:

- Kleiner Perkins surprises, with $200 million “pandemic” fund

- Venture capitalist taps green technology

- Kleiner Perkins’ green keiretsu

- John Doerr has gone half-Green; gets word to President

Tags: tiecon, tiecon2006, conference, entrepreneurship, socialentrepreneur, greentech, cleantech, environment, pollution, pandemic, technology, innovation, venturecapital, johndoerr, zoliblog

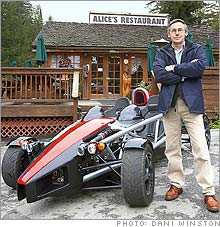

Oh, boy, and I thought $85K was way

Oh, boy, and I thought $85K was way  The Flying (well, almost) Bug is street-legal, but he cannot fire up the jet… although “Patrick says that once in a while he puts on a crash helmet (mainly as a sound muffler), takes the car out on nearby Highway 237 in the wee hours of the morning and fires it up for a brief and hopefully cop-free run.”

The Flying (well, almost) Bug is street-legal, but he cannot fire up the jet… although “Patrick says that once in a while he puts on a crash helmet (mainly as a sound muffler), takes the car out on nearby Highway 237 in the wee hours of the morning and fires it up for a brief and hopefully cop-free run.” Update (5/9): See

Update (5/9): See  Every time officials launch an investigation into gas prices, the damned thing defiantly climbs further up.

Every time officials launch an investigation into gas prices, the damned thing defiantly climbs further up.

.

.

Recent Comments